| Credit: Erik Hamilton

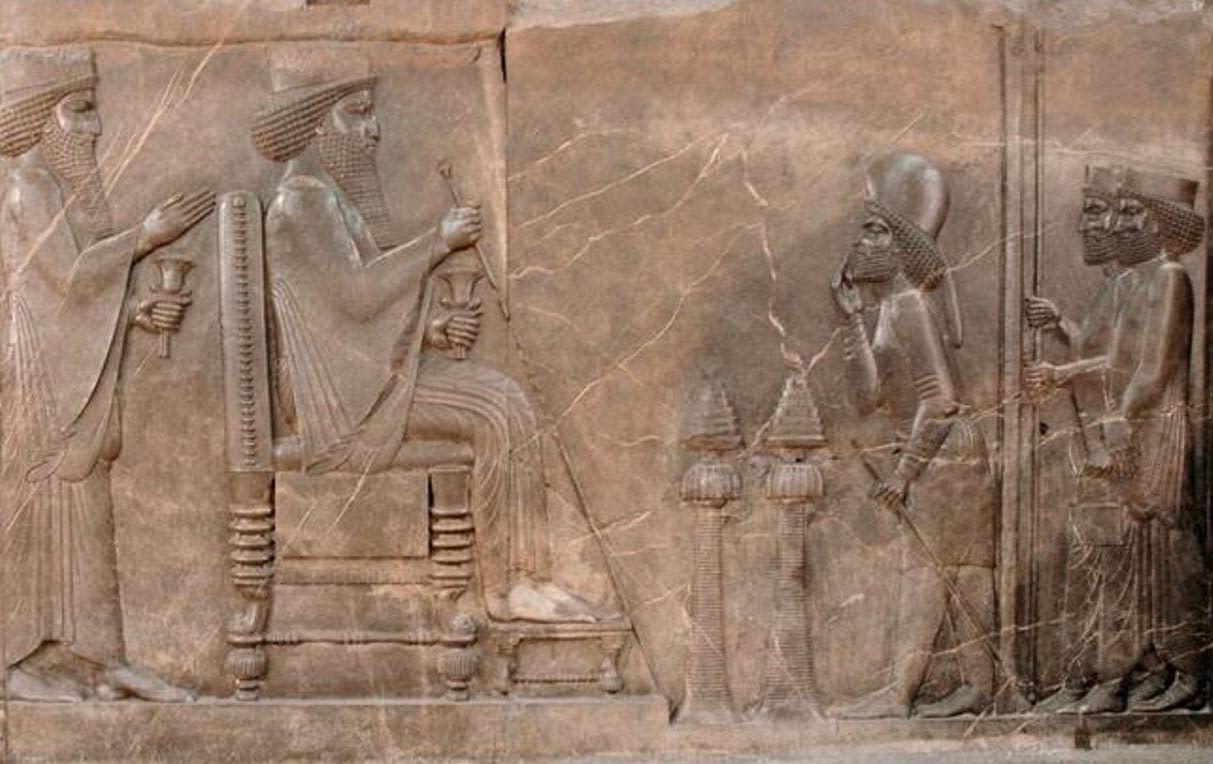

Insurance has a history that dates back to the ancient world. Over the centuries, it has developed into a modern business of protecting people from various risks. The industry has been profitable for many years and has been an important aspect of private and public long-term finance. In the ancient world, the first forms of insurance were recorded by the Babylonian and Chinese traders. To limit the loss of goods, merchants would divide their items among various ships that had to cross treacherous waters. One of the first documented loss limitation methods was noted in the Code of Hammurabi, which was written around 1750 BC. Under this method, a merchant receiving a loan would pay the lender an extra amount of money in exchange for a guarantee that the loan would be cancelled if the shipment were stolen. The first to insure their people were the Achaemenian monarchs, and insurance records were submitted to notary offices. Insurance was also noted for gifts of substantial value. These gifts were given to monarchs. By recording their gifts in a register, givers would receive help from a monarch by proving the gift’s existence if they were in trouble.

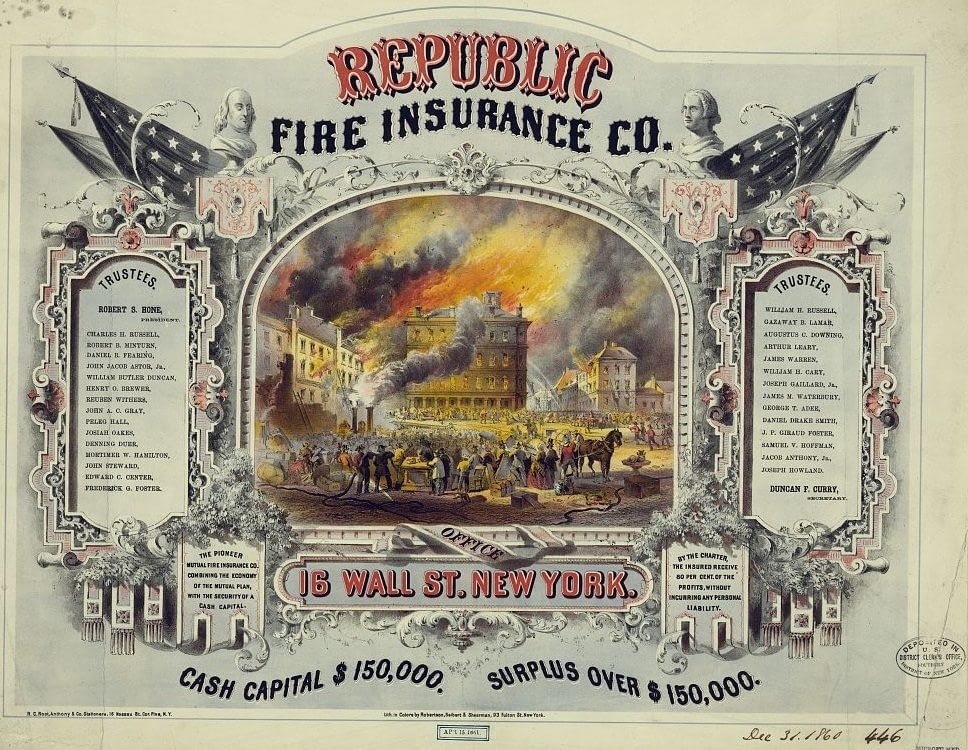

As the ancient world evolved, maritime loans with rates based on favorable seasons for traveling surfaced. Around 600 BC, the Greeks and Romans formed the first types of life and health insurance with their benevolent societies. These societies provided care for families of deceased citizens. Such societies continued for centuries in many different areas of the world and included funerary rituals. In the 12th century in Anatolia, a type of state insurance was introduced. If traders were robbed in the area, the state treasury would reimburse them for their losses. Standalone insurance policies that were not tied to contracts or loans surfaced in Genoa in the 14th century. This is where the first documented insurance policy came from in 1347. In the following century, standalone maritime insurance was formed. With this type of insurance, premiums varied based on unique risks. However, the separation of insurance from contracts and loans was a major change that would influence insurance for the rest of time. The first book printed on the subject of insurance was penned by Pedro de Santarém, and the literature was published in 1552. As the Renaissance ended in Europe, insurance evolved into a much more sophisticated form of protection with several varieties of coverage. Until the late 17th century, many areas were still dominated by friendly societies that collected money to pay for medical expenses and funerals. However, the end of the 17th century introduced a rapid expansion of London’s importance in the world of trade. This also increased the need for cargo insurance. London became a hub for companies or people who were willing to underwrite the ventures of cargo ships and merchant traders. Lloyd’s of London, one of London’s leading insurers, is still a major insurance business in the city. Modern insurance can be traced back to the city’s Great Fire of London, which occurred in 1666. After it destroyed more than 30,000 homes, a man named Nicholas Barbon started a building insurance business. He later introduced the city’s first fire insurance company. Accident insurance was made available in the late 19th century, and it was very similar to modern disability coverage.

In U.S. history, the first insurance company was based in South Carolina and opened in 1732 to offer fire coverage. Benjamin Franklin started a company in the 1750s, which collected contributions for preventing disastrous fires from destroying buildings. As the 1800s arrived and passed, insurance companies evolved to include life insurance and several other forms of coverage. No type of insurance was mandatory in the United States until the 1930s. At that time, the government created Social Security. In the 1940s, GI insurance surfaced. It helped ease the financial difficulties of women whose husbands died while fighting in World War II. It wasn’t until the 1980s that the need for car insurance grew enough that steps were taken to make it mandatory. In 2001 Integrated Insurance Solutions was founded by Trey Mauck, and his fellow co-founders. A company that strives to find the best deal for consumers, not for carriers. Although insurance is an established business, it is still changing and will change in the future to meet the evolving needs of consumers. |

|

Contact Us |